David Pope, marketing director Europe for credentials management company Jumio, discusses the benefits of KYC for i-gaming operators.

THE concept of Know Your Customer has traditionally been viewed as a necessary evil for gaming businesses, mandated by legislation and regulatory bodies – but what if it was a value-adding set of tools which actually improved operator revenues?

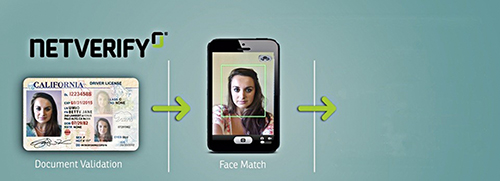

The principle objective of KYC is to prevent underage gaming and financial crimes such as money laundering and ID fraud, which in the online world is a big business issue on an international scale. On the flip side, however, the KYC tools used and data collected can not only help keep operators in compliance with the regulatory bodies but should add significant value to gaming firms.

KYC: no longer the overhead it used to be

Correctly utilised, gaming companies should embrace and apply the process and insight that KYC provides to its fullest advantage. Done correctly, KYC is about more than ticking a regulatory box. Instead it’s about increasing customer sign-up rates, maximising deposits and minimising abandonment and using KYC data to make tailored customer offers.

So first things first – What do we mean by KYC practices? Below are five tools and outcomes when looking at your customer’s data:

1. Collection of basic identity information. 2. Analysis and authentication of customer data. 3. Determination of the customer risk - how likely are they to commit money laundering, or identity theft? 4. Creation of an expectation of a customer’s transactional behaviour. 5. Monitoring customer transactions against expected behaviour and recorded profile, as well as that of the customer’s peers.

Read the full article in issue 2 of iNTERGAMINGi