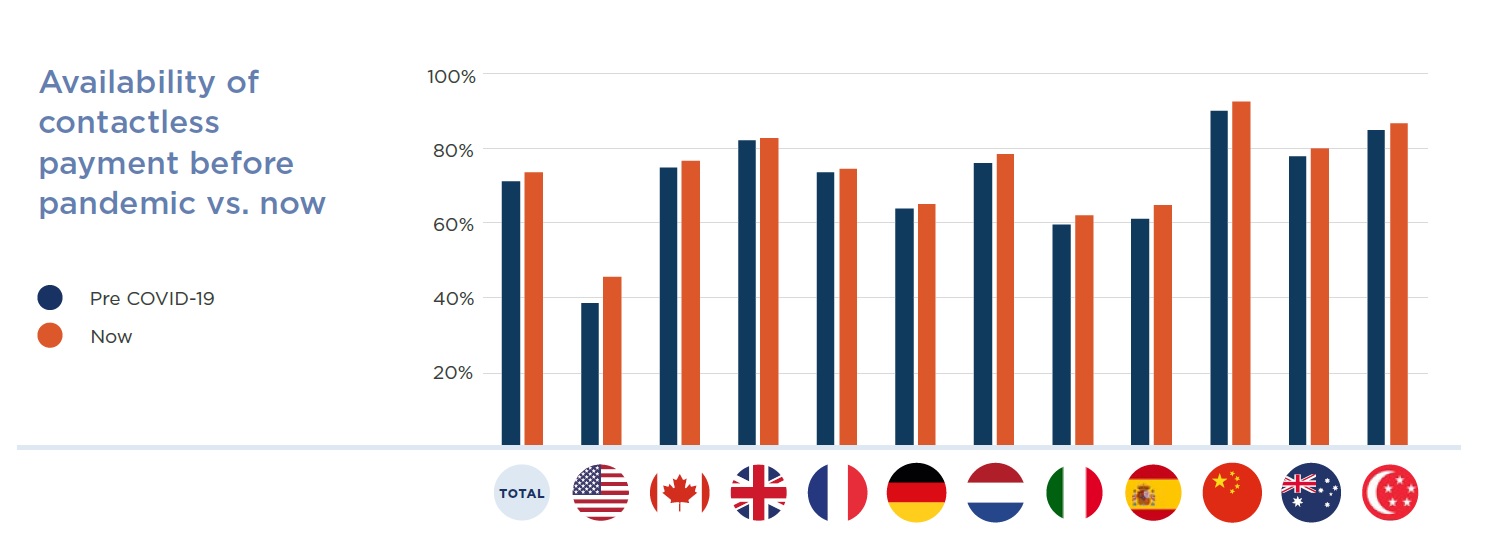

In a new consumer trends report, pre-pandemic payment methods varied widely from country to country, even within the EU and between the US and Canada.

The report, Global Consumer Trends – The New Normal, is the result of over 11,000 interviews conducted by Dynata taking in 11 countries with 1,000 interviews in each.

The EU sector found 11 per cent of people in Germany and 13 per cent in Italy had no ‘plastic’ and no phone app to make payments. This was double the percentages in the UK, France, the Netherlands and Spain and similar to the US – with 10 per cent. Canada was closer to the European trends with 3 per cent and Asia-Pacific countries such as China, Australia and Singapore also tended to have low numbers of people not carrying alternative forms of payment.

Looking at the types of card, chip and PIN or chip and signature, there were also marked differences. The highest proportion of contactless or phone app was in China where 90 per cent have at least one of them. Singapore had 85 per cent falling into that category too. The UK has 81 per cent carrying contactless ability, Australia 78 per cent but in the US only 40 per cent had the means to pay contactless.

Since the outbreak of COVID-19 and the general advice to use cards instead of cash and contactless rather than chip and PIN or chip and signature – and that has only been in the past few months – there has been a sharp increase in the availability of contactless methods. The US has seen the largest movement, from 38 per cent to 46 per cent owning a contactless method of payment.

The ‘cash is king’ concept has receded rapidly. Before the pandemic 22 per cent of respondents across all countries expressed a preference for cash. This has now dropped seven points to 15 per cent with the largest fall in Germany where those expressing a preference for cash dropped from 43 per cent to 33 per cent. In Italy and Spain there are also large drops in the preference for cash to be the main method of payment, down 10 points and 13 points respectively.

Spain has seen the biggest percentage movement away from cash with 29 per cent preferring cash moving to just 17 per cent, a reduction of 43 per cent. Another large shift was in the UK with 42 per cent, in China with 40 per cent and Canada with the same movement.

Interestingly, of the 25 per cent of people who had no contactless ability pre-pandemic, around one-third of them say it is extremely likely or very likely that they will get one soon.

Said the survey team: “It appears the pandemic will have accelerated the movement from cash to plastic and from PIN or signature plastic to contactless methods, whether via cards or smartphone apps. It seems unlikely that contactless behaviours learned or reinforced during the pandemic will be abandoned after it is over."The example of countries that are well “ahead” in the move to contactless demonstrates how simple, convenient and easy it is to pay by card rather than cash. It is also more secure for the retailer, even for mundane and low value activities such as buying a drink in a bar or a loaf of bread at a bakery.”