Central control systems mitigate fraudulent gaming practices.

WE are facing new gaming market expansions in several jurisdictions, mostly in distributed land-based and online markets.

These expansions are driven by hunger for income from gambling activities triggered by the not-so-shiny economic situation. The main question regulators face is how to efficiently collect taxes from regulated gambling activities. But this is not the only one being observed.

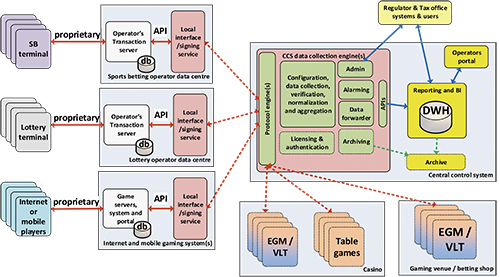

The aim of the central control system is to ensure that gaming is conducted honestly, competitively and free from criminal and corruptive elements. Most of the gaming regulators follow three major goals: that gaming is legal and is conducted in accordance with regulations (also crime prevention); protection of minor and vulnerable groups of people from being harmed or exploited; and tax and dues are efficiently collected.

By use of technology and processes most of these goals may be at least well backed up. The term “central control” stands for technological, procedural and operational measures taken to follow these goals.

It seems that the move from flat rate taxation to tax based on gross gaming revenue (GGR) is the biggest challenge regulators face. Flat taxation is usually a simple task of selling monthly stickers or collecting a yearly flat fee from operators. On the other side procuring taxation on GGR may turn into a nightmare if not planned and implemented correctly. Mainly because of how humans think and strive to catch their profits. It is all about humans - operators, bartenders, players and tax officers - after all.

Read the full article in the January issue of InterGaming