Las Vegas Sands is considering a bond sale to pay for a dividend or stock buyback.

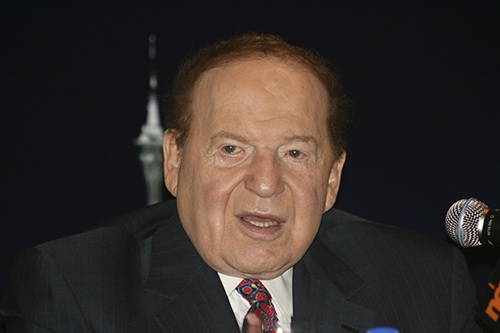

Board members of the company are discussing borrowing rates to finance a possible buyback or dividend payment, Sheldon Adelson (pictured), the company’s founder and chief executive officer, said.

“We have a very positive attitude toward doing this,” Adelson said. “We’re not at the finish line, but we’re in our final stretch.”

A dividend or buyback would further Adelson’s stated goal of returning cash to investors. Apple sold $17bn of bonds on April 30 in the biggest corporate bond sale ever. Las Vegas Sands finished the first quarter with $2.38bn in unrestricted cash and total debt of $9.83bn.